The winds are blowing stronger than ever with experts predicting a global surge in offshore and onshore wind development. Despite the COVID-19 pandemic and a slowdown in 2022 driven by inflation, inefficient permitting and licensing rules, and higher logistics costs, the industry is poised for significant growth.

In March 2023, The Global Wind Energy Council in Brussels released its annual Global Wind Report, which projects 680 gigawatts of new onshore and offshore wind developments will be installed by 2027 – enough to electrify 657 homes annually.

“The twin challenges of secure energy supplies and climate targets will propel wind power into a new phase of extraordinary growth,” the Council says in its report.

The passage of the Inflation Reduction Act in the U.S. in August 2022 is expected to drive the expansion of wind energy’s role in powering American homes. Globally, the U.S. ranks second behind China in annual wind capacity, but still lags other countries in total generation and energy penetration, according to The Land-Based Wind Market Report: 2023 Edition.

In 2022, Denmark generated 57 percent of its power needs via land-wind developments, compared to 10 percent in the U.S., where cumulative land-wind capacity exceeded 144 gigawatts (GW) in 2022, according to the same report.

In the U.S., there are 93 land-based wind projects with a total capacity of 20,176 MW, including 10,018 MW under construction and 10,158 MW in advanced development, writes the American Clean Power Association in its Clean Power Quarterly 2023 Q1 report. Land-based wind is a critical part of the U.S. energy mixture today despite a 14 percent decrease in the land-based wind pipeline as of early 2023.

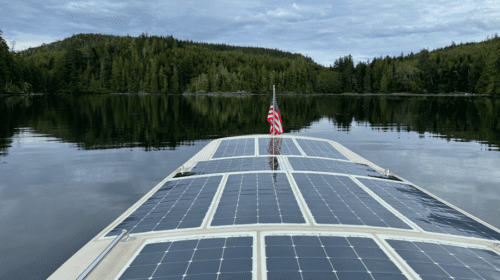

While offshore wind projects account for an even smaller amount of energy generation than land-based developments, the industry is also surging as it strives to meet the Biden administration’s goal of deploying 30 gigawatts (GW) offshore wind energy by 2030.

“Currently, the only offshore wind projects in operation are two demonstration projects, Block Island Wind Farm in Rhode Island and the Coastal Virginia Offshore Wind project,” says Sam Salustro, vice president of strategic communication for The Business Network for Offshore Wind. “That’s seven turbines producing 42 MW of power.”

But two more, the South Fork Wind and Vineyard Wind 1 projects, are under construction and set to begin producing power by the end of the year. Once completed, 932 MW more of offshore wind generation will be connected to the grid, or 0.9 GW.

“This is enough to power over 300,000 homes with clean electricity,” explains Salustro. “States are the primary drivers of the offshore wind market by buying the power and, collectively, they have state targets that reach about 87 GW of power generation – enough to power tens of millions of homes. In the future, we expect to see whole states being primarily powered by offshore wind.”

California, for example, has set a goal of constructing five GW of projects by 2030 and 25 GW by 2045, while Maine has set a goal of three GW by 2040. Ohio is working to establish an offshore wind farm in Lake Erie that would be the first U.S. freshwater farm in state-controlled waters.

In 2022, the Bureau of Ocean Energy Management (BOEM) hosted the first-ever auction for offshore wind leases when a record nine leases began.

“Offshore wind is being looked at to power hard-to-electrify sectors of the economy,” says Salustro. “By using offshore wind power generation to produce green hydrogen or ammonia, we can create a new energy source for factories or transportation with zero emissions.”

The federal government has also proposed leasing agreements in the Gulf of Maine and the Gulf of Mexico. In those deeper waters, floating wind platforms rather than fixed-bottom turbine foundations will be necessary.

“Floating wind turbines also have the potential to open vast new swathes of ocean to offshore wind,” Salustro adds. “Floating turbines can be constructed in waters of much greater depth than fixed foundation technology that is used worldwide.”

Since floating technology is still in its infancy globally, the U.S. has a real opportunity to become an industry leader, according to Salustro. Recognizing that potential, the federal government has significantly focused on developing domestic capabilities and research.

“The Floating Offshore Wind Shot aims to reduce the cost of floating technology by 70 percent by 2035 by supporting research and development,” says Salustro. “The West Coast and Gulf of Maine contain water depths too deep for traditional turbines, and states have big plans for offshore wind development.”

When asked about the most significant challenges facing the offshore wind industry, Salustro replies: the supply chain. He added that the U.S. must build a robust and deep domestic supply chain capable of achieving national and state offshore wind targets, which will play a critical role in the energy transition.

Today, supply chain elements – including manufacturing facilities, ports, vessels, and even university programs – are severely constrained worldwide as demand for offshore wind seemingly grows exponentially.

“For the U.S. to ensure offshore wind projects are completed in a timely fashion and affordably, we must localize a supply chain that grows jobs domestically,” Salustro says. “New Jersey is already playing a critical role in this. A new foundation manufacturing facility in Paulsboro supplies U.S. projects with monopile pieces, large rolled-steel structures, and hundreds of welders and factory workers. A new offshore wind port in Salem County will be one of the hubs of the industry, and a new maintenance port is breaking ground in Atlantic City.”

While there is a strong headwind to push forward with development of wind projects, they are not without blowback. For example, the massive wind farm project that includes 100 wind turbines off the coast of New Jersey’s resort towns Ocean City and Atlantic City is laden with controversy. Despite the fact that the project would generate energy to power 500,000 homes in the area, developers are now facing lawsuits to stop its installation.

Across the country, opposition to renewable energy projects has also led to bans, moratoriums and other restrictions making the transition to renewable energy sources complex and contentious in some parts of the U.S.

Headline photo courtesy of Block Island Wind Farm.

Katie Navarra is a non-fiction writer. Her byline has appeared in Popular Science, The Motley Fool, Education Dive, ChemMatters, Society of Human Resources Management, Western Horseman Magazine and Working Ranch, among others.