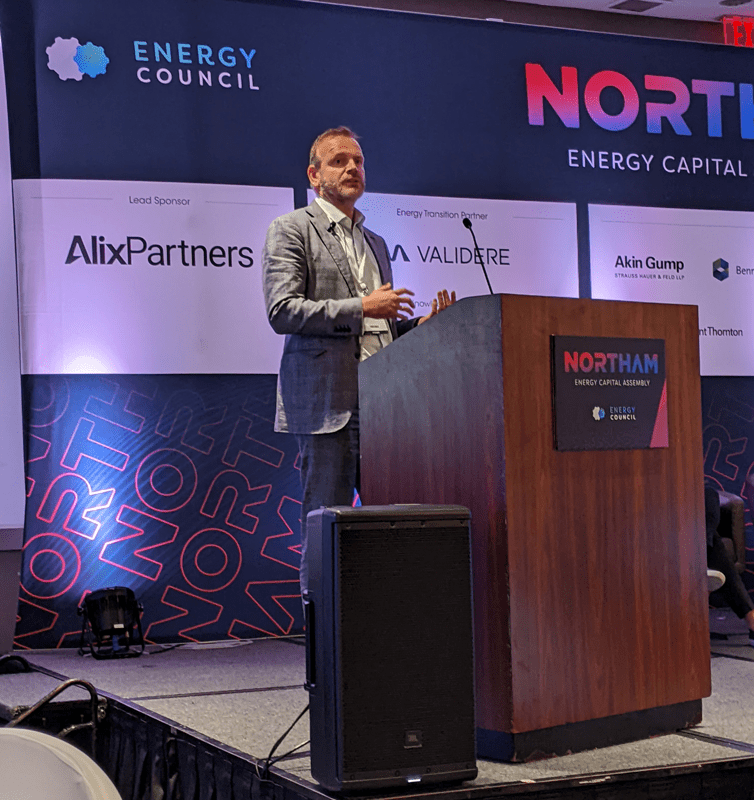

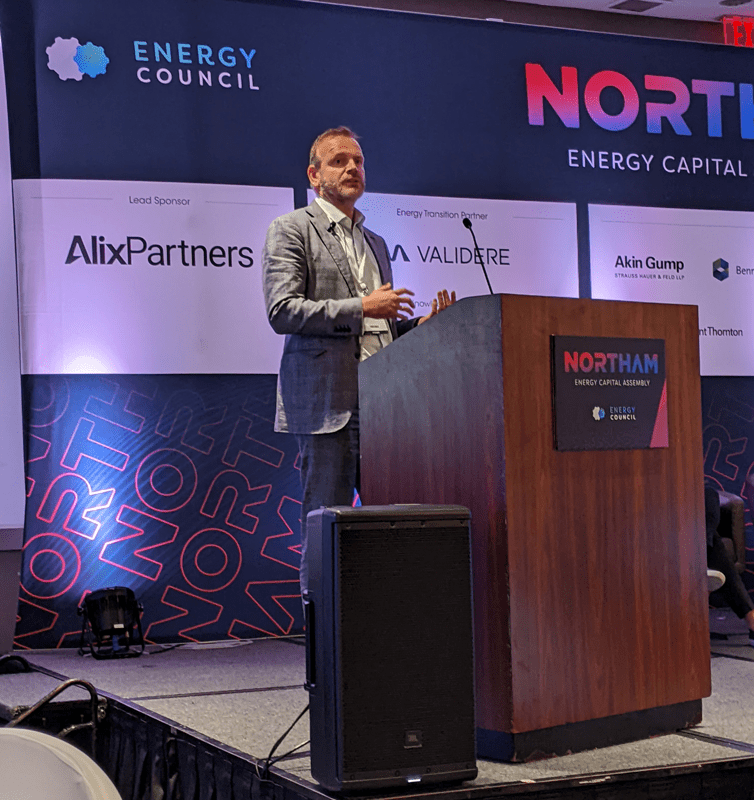

This was the provocative opening line of Martijn Dekker’s keynote speech late last year at an energy conference in Houston, Texas. CEO of ZeroSix, the newly launched carbon credit solution provider, Dekker looked out at the audience, comprised mainly of oil and gas operators and industry finance people, and then over at his fellow panelists.

“Their jaws dropped and it was like, ‘What the hell is this guy talking about?’” Dekker recounts. Perhaps still in a state of shock, and before they could boo him off the stage, Dekker says he clarified that he was not advocating for shutting down the oil and gas industry – an unlikely stance coming from a 25-year veteran of Shell. That industry credibility may have helped buy him enough time to explain the concept of his new company to the audience.

According to the Energy Information Administration (EIA), there were just under one million producing oil and gas wells in the United States in 2021 and Dekker says the bottom quartile of those produce less than 10 barrels of oil per day. In addition, the Environmental Protection Agency (EPA) puts the number of wells classified as “orphaned” (those with an owner that is either unknown or insolvent), and abandoned (unproductive wells with a known operator) at over three million. Many are leaking carbon dioxide (CO2) and methane, as well as various chemicals, such as arsenic, benzene and hydrogen sulfide (H2S), which have the potential to contaminate not just the air, but also aquifers, groundwater and the soil.

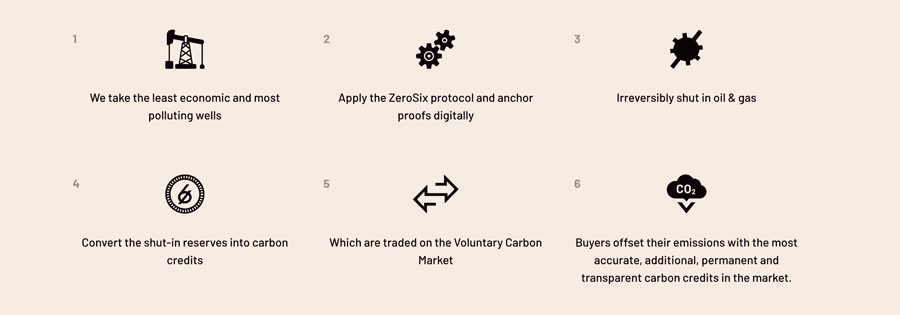

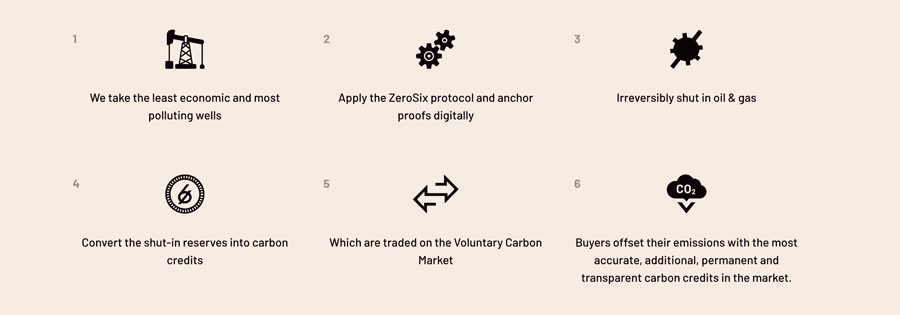

As Dekker explained to his shell-shocked audience, while the industry is in the midst of the energy transition – which will take time – “we can clean up our act” by shutting in the least efficient, most polluting wells and replacing them with carbon credits. A productive panel discussion followed and many in the audience were receptive to the message, approaching Dekker afterwards to share that they agreed a solution needs to be found.

“I think it really resonates,” he says. Since publicly launching in November 2022, the company has talked to a large number of oil and gas producers, many of which have expressed an interest in working with ZeroSix. “They actually do want to shut in some of their wells. They now see it’s an alternative rather than selling it to the next guy and always having that threat of abandonment hanging over their head if the company they sold it to goes bankrupt. Maybe there’s a better way of dealing with it and monetizing it by getting carbon credits.”

Pivotal Moment

With a Master of Science in Chemical Engineering from Eindhoven University of Technology and an MSC in Business and Management from University of Aberdeen, Dekker started his career with Shell in 1996 as a project engineer seconded to Elf on the Shearwater/Elgin Area Line (SEAL) natural gas export pipelines in the North Sea. Over the course of his career, he worked in the upstream, midstream, commercial and technology sectors, culminating with his role as Shell’s VP of Strategy and Portfolio – Projects and Technology in his last five years with the company.

In what would prove to be fortuitous timing, Shell began formulating its strategy to navigate the energy transition in 2016 and Dekker was perfectly positioned to begin a personal transition of sorts.

“I had the fortune to work on Shell’s strategy team in its headquarters,” he says, “and, interesting enough, my remit was to look at the technology side of things – and everything related to the energy transition had a technology angle.” As he researched and studied carbon offsets, carbon sequestration, clean hydrogen, biofuels and the company’s whole digital strategy, it gave him insight into the mechanisms that are necessary for an organization to put in place as it navigates the transition.

“As I was in the midst of looking at all these big trends, I think the one takeaway I had is, it’s an energy transition – not an energy revolution. It’s a transition, as it’s always been,” Dekker says, pointing out the progression from coal to oil and gas and now to low carbon fuels. The growing sense of excitement over the significant opportunities he foresaw was one of the reasons he decided the time was right to strike out on his own.

“There’s so much opportunity to build on the existing energy system and make maximum use of what’s already there. We can start reducing emissions and start avoiding CO2 emissions, stop global warming, and accelerate the transition.”

“Having the opportunity to work on Shell’s global strategy team and leading some of the strategy work was a pivotal moment for me,” Dekker says and recalls thinking, “This is actually a really cool space.”

Voluntary Carbon Markets

In the year before the official launch, Dekker put together a team, including several other industry veterans from Shell, and formed ZeroSix. The company name is “quite simple,” as he explains, “Zero is zero and six is the atom number in the periodic table for carbon, so ZeroSix is transitioning to a zero carbon economy.”

During his time at Shell and upon leaving, Dekker had a number of realizations: To address climate change and global warming, and avoid emissions, we have to do everything we can. “I believe in letting the market do its work. It would be a great solution if there would be a global carbon price that everyone subscribed to because that would actually provide the best market mechanism,” but international agreements don’t happen quickly and time is of the essence. “We can either wait for the perfect solution or let’s actually move quicker,” Dekker says, citing the significant impact the compliance carbon markets, like the European cap and trade and California cap and trade system, and others, have already made.

Dekker emphasizes the role he believes voluntary carbon markets can play, as well, because they allow people and companies to go further than what regulations require, and he believes customers typically have a desire for companies they buy from to exceed what is mandated by the government. At present, the carbon credit market is very small and the volume of high quality credits is low, so it seemed only natural for Dekker and the team at ZeroSix to ask themselves, “How can we help with that?”

Proactive Stance

With his extensive background in the oil and gas industry, Dekker is well aware of the staggering number of orphaned and abandoned wells, and the environmental damage they can potentially do, which led to another realization: “Isn’t it much better to get ahead of the problem?” The idea is to shut in the least producing, highest polluting wells before they are abandoned.

Knowing exactly how much oil and gas are in the ground makes it possible to calculate the amount of CO2 a well will emit, and shutting in the well offers the solution to prevent future emissions. “This provides a market mechanism where people are incentivized to retire their wells earlier in return for carbon credits,” Dekker says.

All Credits are not Created Equal

As Dekker and the team at ZeroSix continued their due diligence, a major realization was that not all carbon credits are of the same quality, which then undermines the credibility of the voluntary carbon markets, something Dekker stresses are very important mechanisms to accelerate the energy transition and reduce emissions. This led to the question: How could ZeroSix ensure that people know where their carbon credits originate and that they are of the highest quality?

A lot of the carbon credits currently in the market are based on the premise that they avoid deforestation, which, on the surface, seems like an environmentally sound practice and a noble achievement; however, Dekker references an investigative report by The Guardian and Die Zeit newspapers, along with the nonprofit organization, SourceMaterial, that discovered a large percentage of rainforest offset credits may actually be “phantom credits” that have little impact on carbon reductions.

“I love nature based offsets because there are a lot of co-benefits,” Dekker says, “but it’s just harder to quantify them.”

The Four Pillars

Each of these discoveries was critical in helping Dekker and the ZeroSix team create a framework around which the company is built and establish the four pillars under which it operates.

Accuracy. Shutting in oil and gas wells was chosen, in part, as the starting protocol because the industry is so heavily regulated, the data is very well underpinned, and there are clear standards and regulations that can be used for independent verification. “Our carbon credits will be very accurate,” Dekker says, “because you can calculate emissions.”

Additionality. In checking its protocols, the team at ZeroSix consulted a professor at Stanford, who said people talk about a well as oil and gas coming out of the ground, when, in reality, it’s much simpler: It’s a hole in the ground that money comes out of.

Acknowledging that producers are not going to be willing to shut in their wells as long as they are economic, Dekker recounts this story to emphasize that ZeroSix uses the Security and Exchange Commission (SEC) standard to determine what is economic, something he considers to be a conservative estimate, and says, “Almost by definition our credits will be additional.”

Permanence. Targeting more mature wells with less production, but that are more polluting, means that once they’re shut in, they will not be redrilled in the future. While the process of shutting in a well – injecting cement into the wellbore – is more or less a permanent solution in and of itself, making it cost-prohibitive to redrill, Dekker says, “In addition, because we want to go belts, braces and suspenders, we also ask the owners of the well for a contractual commitment to not developing those wells for the next 50 years.”

Transparency. Because of what one of the co-authors of The Guardian reports refers to as “the wild west that is the carbon markets,” Dekker says, “We think it is extremely important to gain trust and give everyone access to the documentation that proves this is a valid carbon credit. We built a digital platform that basically records all the information that is required to create a carbon credit. We store it on a distributed ledger – blockchain – and then, until the end of time, people can see the evidence and have confidence that this is indeed a very high quality carbon credit.”

Ultimately, Dekker says, the company’s vision on the technology side is to be able to provide independent verification for any environmental claim. “In my free time – which is not that much – I try to be a grape grower for wine making, so sequestering carbon in the soil by changing your farming techniques is something I’m personally very excited about. I think it’s got a lot of potential, and I think the technology is getting very close to actually measuring how much carbon is sequestered in the soil. Once you can do that, you can calculate and monitor it. I think that would be another great protocol we could host on our platform.”

Sending A Message

There is a commonly held belief within the oil and gas industry that it has not done a good job of accurately conveying its story to the public, so the media has told the industry’s story for it and, particularly as time has gone on, in a damning – and many contend, an unfair – light. Dekker believes there is an opportunity for the clean tech industry to do better.

“There’s such a tremendous space when you talk about the energy transition,” he says. “Maybe a big message here to the clean tech industry is, of course, everyone wants that focus and attention on what they’re doing, but we’re all collectively better off advocating for an inclusive approach. Let’s do everything we can to accelerate the energy transition.”

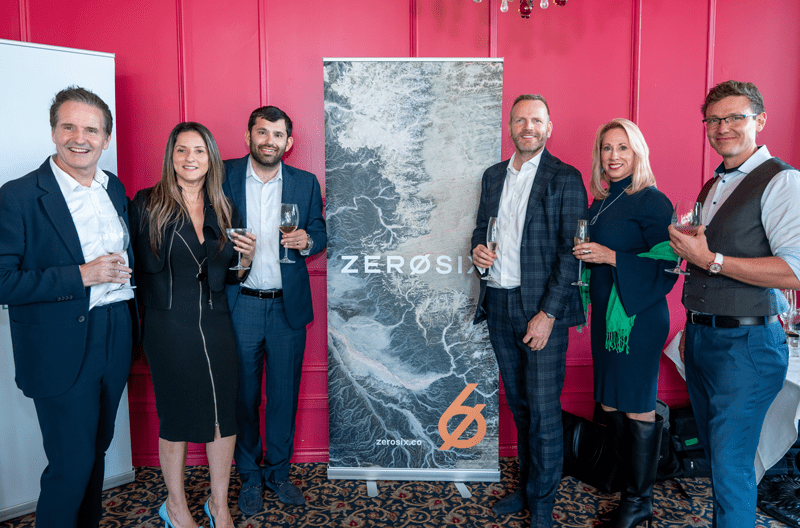

Headline photo: The Houston team celebrating the public launch of ZeroSix. From L to R: Scot Fraser, Strategic Advisor; Luciana Monteiro, Head of Marketing & Communications; Humberto Sirvent, Chief Finance Officer; Martijn Dekker, Chief Executive Officer; Samantha Holroyd, Chief Commercial Officer; Ondrej Sestak, Head of Engineering.

Rebecca Ponton has been a journalist for 25+ years and is also a petroleum landman. Her book, Breaking the GAS Ceiling: Women in the Offshore Oil and Gas Industry (Modern History Press), was released in May 2019. For more info, go to www.breakingthegasceiling.com.