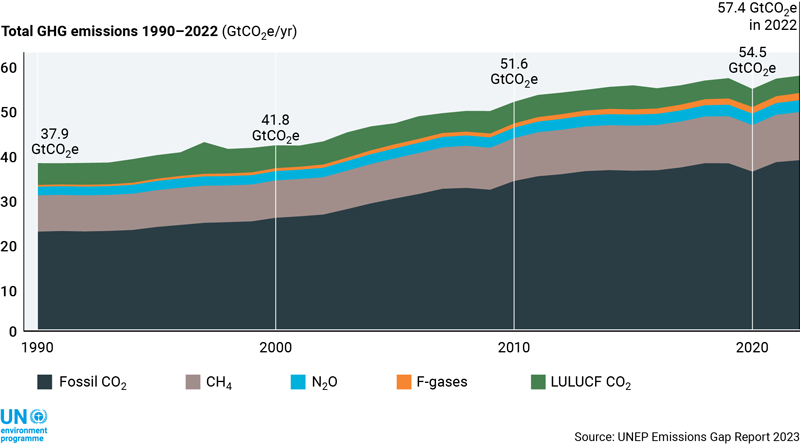

The global shift to cleaner energy, net zero carbon emission pledges, and increased extreme weather events are shaping the energy transition. Human activity continues to increase carbon dioxide, methane and other greenhouse gas emissions, causing the earth’s overall temperature to increase. Future warming depends on the magnitude of emissions this decade and beyond. Climate scientists state that predicted 2030 carbon emissions must be reduced by 42 percent to limit warming to the current 1.5 Celsius, the U.N. Environment Program 2023 Emissions Gap Report states.

Developed technologies can impact the current carbon emissions gap. With investment and resources, some can scale. New financing structures and partnerships are available for bankable renewable energy and low carbon projects. The 2023 annual International Energy Agency (IEA) report shows that for every $1.00 invested in fossil fuels, $1.70 is invested in clean energy technologies. Five years ago, fossil fuels and clean energy investments were about even.

I worked in the private, government and nonprofit sectors at different periods in my career. Blended finance structures incorporating policies, guidelines, financial and non-financial returns, and other requirements from each sector are expanding. Historically, this structure principally focused on investments in developing countries. Regions in developed countries are benefiting from blended finance structures in the wake of net zero carbon emission pledges, other sustainability goals, and increased environmental and climate investments. Investors and lenders include banks, other financial institutions, corporations, government agencies, nonprofits and private investors.

This article broadly focuses on the energy transition in developing and developed countries, which is critical to achieving a globally sustainable economy. Three key factors significantly impacting the energy transition are:

- Regulations, Laws and Public Policies

- Climate Finance and Investing

- Climate Technology and Web 3.0

- Consumer Behavior and Communications

Regulations, Laws and Public Policies

Regulators, lawmakers and public policy leaders distinguish between climate goals generally focused on greenhouse gas emissions (“GHG”) and sustainability goals typically associated with environmental, social and governance goals (“ESG”).

The initial implementation of the European Sustainability Reporting Standards requiring publicly traded and large privately held companies to report their GHG emissions, amongst other green policies, began last month. To be phased in over several years, these standards are designed to help investors better analyze environmental risks through GHG emissions. They include U.S. based companies with securities trading on a European Union regulated market.

The E.U. began initially implementing the 2023 Sustainable Finance Disclosure Regulation (SFDR) to help investors better analyze the impact of sustainability, also referenced as ESG metrics. Its goal is to integrate sustainability risks into the firm’s investment processes and report on their transformation at the company and product level. Investors and other finance professionals are confused about how SFDR-labeled funds are categorized.

Total net anthropogenic GHG emissions, 1990–2022

In the United States, April 2024 is the target release date for SEC requirements for public companies to disclose climate-related risks such as Scope 1, 2 and 3 GHG emissions. Last September, the SEC ruled that investments in any ESG-labeled fund, or any fund that suggests it is sustainability-focused, must be 80 percent aligned with its stated goals. For years, there has been controversy about whether many ESG-labeled funds are fraught with greenwashing and are transparent. This rule is designed to provide investors with clarity.

The passage of the Inflation Reduction Act (“IRA”) in August 2022 directed significant investment in ESG-related initiatives with a focus on clean energy. New ESG legislation followed in 2023 primarily centered on two categories:

- Use of non-financial factors in investment and business decisions

- Corporate disclosures of GHG emissions, workforce diversity, racial equity and gender equity

Much of the new ESG legislation resulted from shareholder proposals. Leading corporate governance practitioners including Simpson Thatcher and Barlett LLP, note that shareholder proposals moved from general requests for additional reporting to more specific requests in 2023. For example, many environmental-focused shareholder proposals requested specific emission targets or the issuance of detailed climate transition reports.

Investment professionals are fiduciaries and, thus, must consider all portfolio risks when investing. Evidence-based research directly links ESG to financial risks. Pension Fund investors’ fiduciary responsibility is to invest the plan solely in the interest of participants and beneficiaries, provide benefits, and pay plan expenses. Endowment and foundation investors’ fiduciary responsibility is to invest consistent with the organization’s missions. Family office and wealth management advisors’ fiduciary responsibility is to their clients.

In September 2015, 193 United Nations member states adopted the Sustainable Development Goals (“STGs”). The 17 STGs are designed to guide the global community’s sustainable development priorities over the next 15 years and stimulate action in areas of critical importance to humanity and the planet. Today, one or more STGs are foundational for businesses and investors seeking to establish sustainable business and investment frameworks for global business operations, policies, and guidelines that introduce paths to identify, commit, measure, monitor and report relevant STGs.

It is challenging to have one universal sustainable investment standard. Methodologies quantifying STGs impact continue to evolve with emerging technologies. Global policy institutes and universities are expanding data science departments or establishing institutes that assess environmental and social impact data. Businesses and investors deploy trained staff and external consultants to prudently navigate across this landscape, accounting for portfolio risks, financial returns, and, where applicable, social impact returns.

Climate Finance and Investments

In the wake of the increasing number of countries pledging net zero carbon emission 2050 goals or sooner, direct investments are significantly increasing in climate technologies, renewable energy, and related products and services supporting low- and zero-carbon solutions.

With the passing of the 2021 bipartisan infrastructure law and the IRA in 2022, renewable energy generation increased substantially, surpassing fossil fuel energy generation. According to the IEA, renewable energy will account for over one-third of the world’s total electricity generation by 2025. With renewable energy products being more efficient and prices decreasing, demand is increasing with the electrification of homes and businesses, the growing role of electric vehicles, rising demand for data centers, and industrial growth.

Waste-based biofuel and solar fuel are examples of alternatives to petroleum and diesel gasoline. How quickly these fuels develop may impact EV adoption and battery storage. In a few years, it will become more apparent with increased capital investment in alternative fuels and consumers choosing an alternative fuel designed for existing automobiles.

Sustainable aviation fuel (“SAF”) is a low-carbon fuel solution for air transportation today. It is produced from non-petroleum-based renewable feedstocks such as wood, yard waste, and other feedstocks; price is one of the primary challenges in scaling SAF. Cost estimates for waste-based SAF are two times more than traditional jet fuel and six to 10 times more than synthetic fuels using carbon capture. Capital investment in emerging technologies may result in more efficient SAF production and a competitive cost structure.

Capital debt, equity and grant options evolve with emerging technologies and tools to assist project developers, operators, and investors. This drives the pace of the energy transition. Trends include:

Debt: S&P Global Ratings forecasted moderate growth in the issuance of green social sustainability and sustainability-linked bonds. The report also anticipates expanding bond types, with green bonds remaining dominant and blue bonds emerging.

Private Capital: Grants, climate, sustainability, and nature-focused private equity and venture funds, fund of funds, and investment platforms across pre-seed, seed, Series A, B and beyond. Private capital investors can also be strategic partners providing resources and advisory with capital. Project developers are often operating a business for the first time and benefit from experienced business advisors. Business operations are structured to include local leaders and community input in the initial planning phase and beyond to achieve the desired impact.

Blended finance structures are designed to include financial and non-financial return requirements to help drive commercial Capital into bankable renewable energy, low- and zero-carbon, nature, and other sustainability projects. Government and philanthropic Capital may offer concessions to attract private Capital, often seeking 100 percent financial returns. Concessionary Capital may be in the form of below market rate loans or credit enhancements with a government entity agreeing to cover five to 25 percent of the first loss of an investment generally, or grants, or capital structured with agreements for a blended rate of return consisting of financial and social impact.

Climate Technologies and Web 3.0

Digital technologies can enhance efficient operations, reduce cost, and increase transparency, including tracking the source of materials and monitoring supply chains. There are carbon credits, agriculture, renewable energy certificates, and investment platforms with all these options for nature, energy, oil and gas, SAF, agriculture and other sustainable projects. The risk/return metrics for investments in developing markets with mostly early-stage projects are only for some. Investors with the following characteristics are amongst those evaluating and investing in these options. More investment will occur as projects mature and structures are considered institutional quality by relevant third parties.

- Trained staff or advisors, and

- the risk capacity to buy and hold these instruments, and

- defined financial and social return profiles, and

- net zero carbon emissions targets.

Institutional quality nature-based and technology-based carbon credits, energy and agriculture certificates are tied to bankable projects and projected to scale. Blended finance structures can significantly impact their scalability.

One-third of the world’s corporations have net zero carbon emission pledges by 2050 or sooner, and few have a definitive path to reach stated 2030, 2040 or 2050 targets. Some of these corporations also have social impact goals. According to Cerulli Associates and others, $53 trillion will be passed down to Gen X, millennials, Gen Z heirs and charities this decade. Blended finance structures with commercial, government and philanthropic capital can help investors achieve net zero carbon emissions and social impact targets.

Consumer Behavior and Communications

The energy transition is much more than achieving low carbon emissions globally. Environmental justice, economic viability, health and wellness factors are integrated in a global energy transition. The pace and magnitude of greenhouse gas emissions today require consumer action, investment in innovative, scalable, low and zero carbon solutions, accounting for carbon emissions, quantifying social impact returns, and global planning for climate mitigation and adaptation.

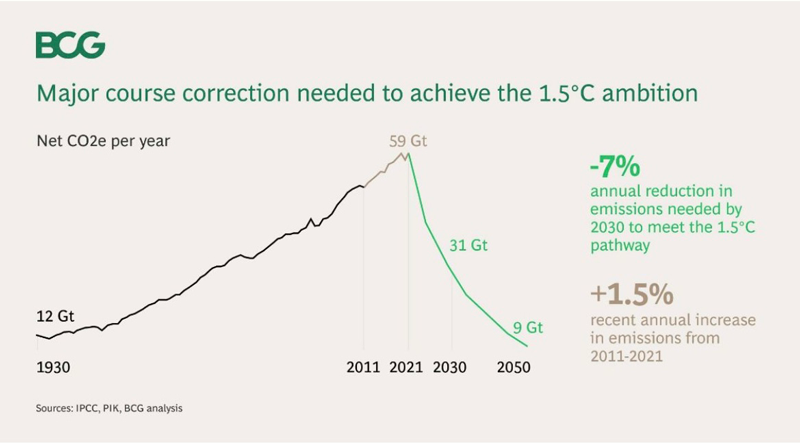

Last year, Boston Consulting Group (BCG) stated that the annual reduction of carbon dioxide emissions required to achieve 1.5 Celsius is -7 percent annually throughout the rest of this decade. Emissions increased by 1.5 percent from 2011 through 2021. This 1.5 Celsius threshold was reached in 2015 during the U.N. Climate Change Conference, where 195 nations established the 17 STGs and pledged to address climate.

With increased education, collaboration and financing, some existing technologies will scale some existing solutions, impacting the current pace of carbon and other greenhouse gas emissions. Why? Multitude factors and events are co-occurring.

In 2030, 2040 and 2050, the next-gen individuals will be decision-makers alongside some of us today. Workplaces and culture differ today in this post-COVID era, particularly in developed countries. Legacy planning reflects this decade’s $53 trillion wealth transfer. Some businesses and individuals are accounting for their carbon emissions with high-quality carbon credits, energy, and agriculture certificates. Some nonprofits, sovereign wealth and pension funds, family offices, individual investors and others are quantifying their preferred social impact returns.

Universities, policy institutions and financial institutions join government agencies in deploying resources, grants and investments into emerging technologies, products and services supporting innovative energy and climate solutions. Climate research and discussions include climate justice, adaptation and resilience. Climate communications is a recognized major, and broadcast meteorologists regularly share evidence-based research on climate and sustainability through shows such as the Weather Channel’s Pattrn and other media.

An educated public can be powerful. Common ground can be achieved if people are provided with accurate information and met wherever they are within this complex global energy transition. Our nation and the rest of the world are positioned meaningfully to shift toward a low carbon global sustainable economy this decade.

https://www.unep.org/resources/emissions-gap-report-2023

Dedicated to advancing a global sustainable economy, with over 25 years as a chief investment officer, business advisor, and board director, Dail St. Claire began her career managing assets for New York City’s $240Bn pension fund. Her service includes being a financial advisor for the Episcopal Church Endowment and Foundation.

St. Claire has advised global corporations and middle market companies with P&L responsibilities as a board director, energy and utility investment banker and investor. With a track record of growing and scaling businesses in highly regulated industries, she co-founded Williams Capital, the largest women- and minority-owned broker-dealer investment bank in the United States today.

St. Claire is the Chief Investment Officer and Sr. Energy Advisor at Aurivos, a family office with deep experience investing in climate tech and energy strategies. Experienced in alternative investments and climate finance, her focus includes designing innovative financial structures for institutional and nonprofit investment in energy, agricultural technology, low carbon, and zero carbon solutions and social impact.

BOARD SERVICE • Independent Board Director, Audit Committee Member, Verde Clean Fuels, NASDAQ: “VGAS”, 2023 – present • Independent Board Director, CRS Temporary Housing, 2021– present • New York State Common Retirement Fund Investment, Board Member, Investment Advisory Committee – Sustainability & Climate Fund, Corporate Governance, $260Bn AUM, 2021 – 2023.

An RRCA-certified running and fitness coach, St. Claire assists challenged athletes through the Achilles Foundation. She holds a BA in Cultural Anthropology from the University of California, San Diego, and an MA in Public Policy/Business from the University of Chicago Harris School. Contact dailst.claire@aurivos.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.