Public and private enterprises are increasingly designing an energy transition strategy for their business given economic opportunities, legal and regulatory requirements, environmental, health and safety benefits, new technologies, and increasing stakeholder demand. Stakeholders, including all constituents impacted by a company’s business – shareholders, clients, management, employees and communities in which they operate, including state and local community leaders – have a crucial role in this process, and their involvement and support is invaluable.

According to the United Nations, 45 percent of public companies (9,000 companies from over 140 countries), have committed to reducing greenhouse gas emissions by 2030. Carbon dioxide accounts for 76 percent of global greenhouse gas emissions. Decarbonization, the process of reducing or eliminating carbon dioxide (CO2) emissions, is not just a part of a business’s energy transition and risk reduction plan; it catalyzes sustainable business practices, paving the way for a more sustainable economy.

This article, focused on companies operating in the U.S., discusses designing a decarbonization strategy and the financial and social return on investment (ROI). The impact of decarbonization varies across economic industry sectors, with specific industries able to reduce carbon emissions by 60 to 80 percent and achieve positive financial outcomes.

The Beginning

The Greenhouse Gas Protocol is a critical element of the energy transition, promoting transparency, accountability, and sustainable practices. First publicly released in 2001 and revised over the years, the Protocol is a comprehensive global standardized framework. It is designed to measure and manage Scope 1, 2 and 3 greenhouse gas (GHG) emissions from electricity and other energy purchases and account for their value chain emissions.

- Scope 1: Direct emissions from sources within a company’s property or operations

- Scope 2: Indirect emissions resulting from purchased electricity

- Scope 3: All other indirect emissions associated with an enterprise’s activities

Decarbonization

U.S. companies, small and medium-sized businesses, and organizations increasingly disclose their carbon footprint voluntarily. Some companies are responding to stakeholder interests or demands, state regulatory requirements, or anticipating the Securities and Exchange Commission (“SEC”) to provide carbon emissions standards for public companies.

Many enterprises are developing targets to reduce their carbon emissions, quantifying their goals, and committing to net zero carbon emissions by 2050 or less or transitioning to a lower carbon footprint, the quantity and time often unspecified.

To implement a successful energy transition and decarbonization plan, a C-suite executive must first assume the responsibility of running this project or appoint a director with a clear reporting line, key performance indicators, and results. The decarbonization strategy director forms a team. Depending on company resources, this team may comprise internal executives, or an external partner may be contracted to work with appointed internal executives. The external partner, hired with a defined scope of work and timeline, can cover any missing internal skills or functions required to access design and execute an effective decarbonization strategy. Functions include energy management, finance, investor relations, legal, facilities, operations, IT, communications, and corporate social responsibility or sustainability. Communicating with all stakeholders early and throughout the development of this strategy is critical to its success.

Key Steps:

- Determine carbon emission baseline from a comprehensive carbon footprint assessment.

- Identify main carbon emission source(s).

- Establish clear, measurable decarbonization targets and goals with industry benchmarks, regular monitoring and reporting guidelines.

- Identify all stakeholders, all who are impacted by your business, including employees, customers, investors, shareholders, board of directors, suppliers, state and local communities and enterprises, and establish a communication feedback loop for engagement and collaboration.

- Develop a roadmap for decarbonization and energy strategies outlining initiatives, actions, and solutions and identifying manageable and impactful projects first.

In 2023, clean energy in the U.S. was the same price as energy burning from fossil fuels due partly to government policy measures, including the 2022 Inflation Reduction Act (IRA).

Clean energy technology investments in 2024 will rise to $800 billion, an additional 10 to 20 percent compared with 2023, according to S&P Global, adding that the average capital expenditures of using clean energy technologies will fall by a further 15 to 20 percent by 2030. Solar energy will account for the largest share of the additional spending and 55 percent of total clean energy investment, followed by onshore wind, battery, energy storage, and carbon dioxide electrolysis. Scarcely in use today, electrolysis uses electricity from renewable and low-carbon energy, converting captured carbon waste into chemical commodities such as ethanol and formic acid.

The cost of solar and batteries is decreasing with the oversupply of products and falling raw material prices. Continued improvements in technology, including the integration of AI, ensure equipment costs will continue to fall, mitigating the upward cost of labor and smart grid development – comprised of grid technologies, devices, and associated systems that provide and use digital information, communications, and controls to optimize the efficiency, reliability and security of electric power delivery.

Companies can transition to a resilient decarbonization plan with the careful execution of a sustainable business framework designed with the company’s team, stakeholder input, and collaboration. Core decarbonization strategies:

Energy Efficiency

- Implement energy-saving measures across operations, buildings, and transportation, educating stakeholders on energy conservation techniques, practices, and impact.

Electrification

- Evaluate and modernize grid infrastructure to accommodate decentralized and intermittent renewable sources. According to the Clean Energy Transition Institute:

- Electric drive trains are 4.4 times more efficient compared to replaced internal combustion that now run on petroleum.

- Electric heat pumps can be more efficient than heat and gas furnaces.

Energy Mix

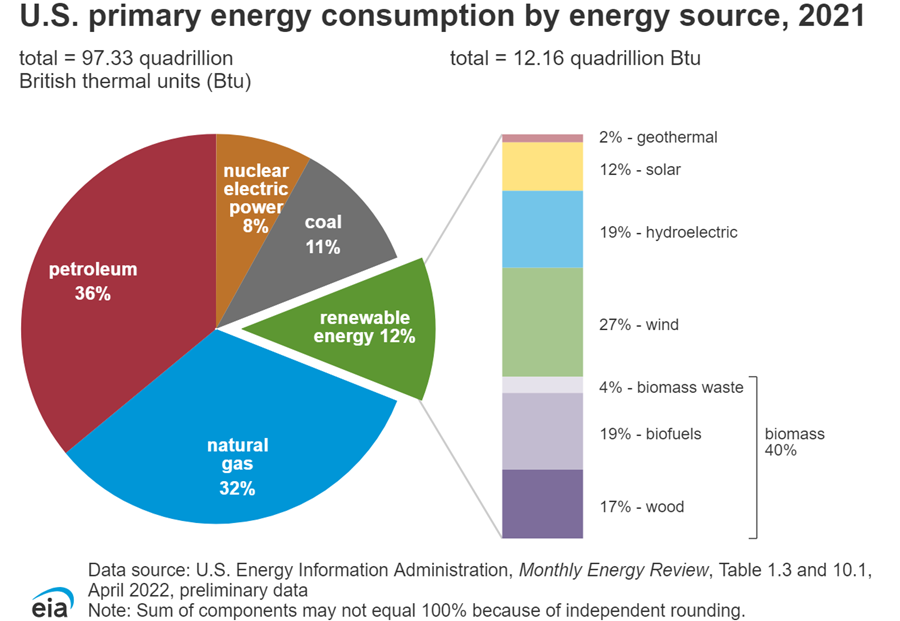

- Not all end uses can or should be electrified. The goal of a decarbonization plan is to lower carbon emissions as much as possible. Mitigate the supply network with natural gas or renewable energies on-site, evaluating the use of solar panels, wind turbines, hydrogen, nuclear energy and biofuels.

Carbon Capture

- For all energy uses that can be neither electrified nor converted to low carbon fuel, capture carbon emissions and sequester them or use carbon emissions to produce clean synthetic fuels (electro fuels).

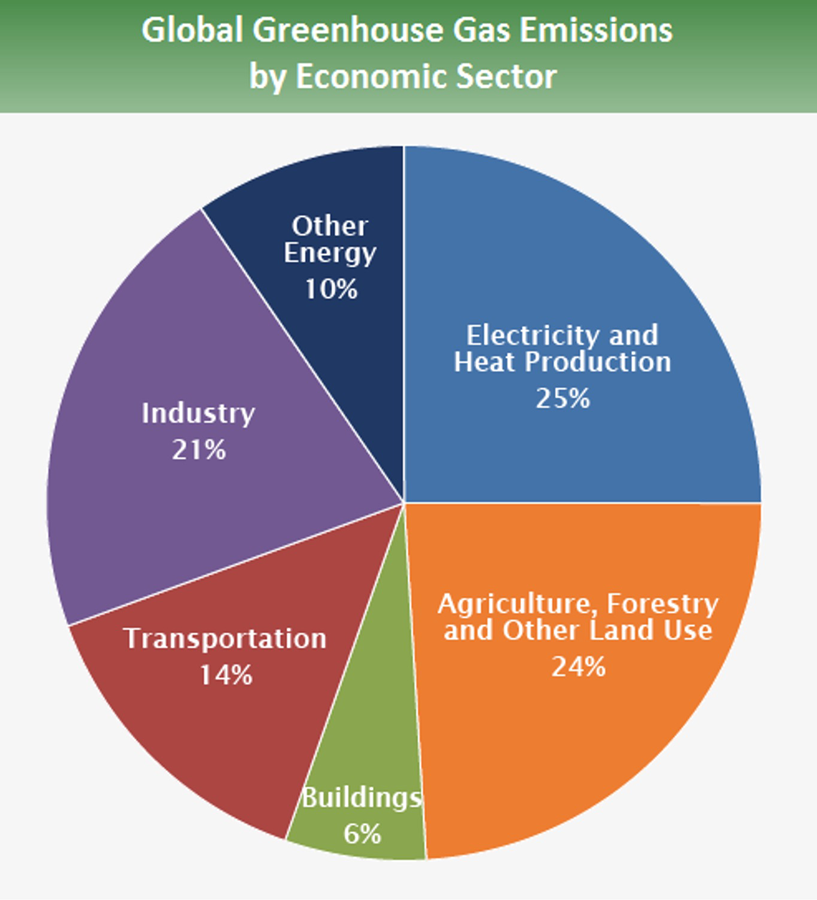

Employee, community, and other stakeholder engagement and collaboration are critical to a successful energy efficient strategy. It also has the lowest implementation cost. Electricity and heat production are responsible for 25 percent of greenhouse gas emissions. By 2058, the world population will increase to 10 billion people from 7.6 billion, according to the United Nations Population Division. Thus, energy and food demand is expected to grow significantly. Commercializing new proven technologies is crucial to unlocking scalable and efficient electrification, energy mix, and carbon capture strategies.

Nuclear energy is the only renewable energy devoid of carbon emissions. Growth trends for nuclear energy are generally flat. Wind and solar are projected to lead growth in U.S. power generation for the next two years. Solar growth is forecasted to grow 75 percent by 2025, according to the U.S., according to the U.S. Energy Information Administration (EIA).

Grid Decarbonization

Commercial, industrial, and residential increasing demand for solar and wind energy are overtaxing U.S. electrical grids. An electrical grid is a network of power plants, transmission lines, and other components that deliver electricity to consumers. Natural gas is generally used during extended power outages and intermittent service.

More than 70 percent of U.S. grid transmission lines are over 25 years old. Technology exists to transform electrical grids into smart grids, increasing usage efficiencies and expanding energy storage systems to support increased transmission and solar, wind, and hydropower. Digital technologies can help reduce carbon emissions by up to 20 percent by 2050 in energy, materials and mobility sectors, according to the International Energy Agency (IEA). New battery, storage, AI and digital technologies can significantly impact grid decarbonization.

Solar Energy and Food Security

Agriculture, forestry and land use are responsible for 24 percent of greenhouse gas emissions. Agricultural innovation, introducing new products, processes, and social and economic structures to increase effectiveness, competitiveness, or environmental sustainability, contributes to food security and economic development. Agrivoltaics, or co-location systems, utilize the land for two purposes: Benefits include increased productivity of certain crops and protection of crops from pests.

Energy producers install solar photovoltaic systems on agricultural land, increasing food production and land use efficiencies and decreasing greenhouse emissions from grazing cattle. Cows are responsible for 60 percent of agricultural greenhouse gas emissions.

Benefits include energy efficiency if an agrivoltaics system is next to a vertical farm. Vertical farms use less land and water than outdoor farms and require electricity. A young industry in the U.S., leading countries in vertical farming include Japan, China, Singapore, Germany and France.

Market-Based Instruments

Financial instruments are additional tools that may be used to advance a company’s energy transition and decarbonization plan. “Greenwashing” refers to falsifying the environmental impact of a company’s or developer’s product to investors or the public that occurred with some of these market-based instruments. New technologies such as drones and machine learning, digitalization and ledger-based marketplaces help to address these challenges.

Renewable Energy Certificates (RECs)

RECs are market-based instruments for electricity generated from renewable energy sources that represent their environmental attributes. State law underpins the legal basis of RECs issued when a renewable energy source such as solar, wind, or hydropower is generated and delivers one megawatt-hour of electricity.

RECs may be sold separately and are traded by power companies, people who own residential energy systems such as solar panels, and third-party market makers.

Voluntary and Compliance Markets

RECs are used in two separate markets – voluntary and compliance. In the U.S., the voluntary markets primarily serve corporate, institutional or individual buyers seeking to meet various environmental and economic goals. The voluntary usage of RECs is recognized by U.S. government agencies’ legal and regulatory regimes, including the U.S. Department of Defense, the U.S. Environmental Protection Agency, Department of Defense, the Federal Trade Commission, and the International Swaps and Derivatives Association (ISDA), with 1,000 members across 79 countries, and the Solar Energy Industry Association (SEIA).

The compliance markets for RECs are often defined by a state renewable portfolio standard requiring a percentage of energy supplied to consumers from renewable resources.

Carbon Offsets and Carbon Credits

Carbon offsets represent emissions that have been removed from the atmosphere, which can be bought to reduce carbon emissions beyond what a buyer can achieve through their efforts. Offsets are bought and sold voluntarily through brokers or marketplace trading platforms.

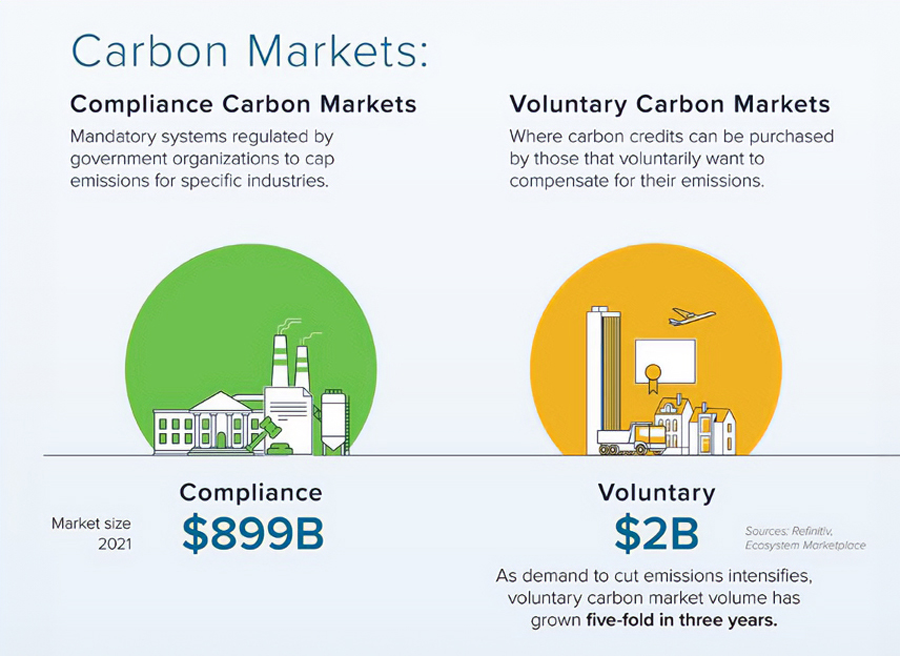

Carbon credits represent an allowance for companies to emit one ton of carbon dioxide (CO2). They are bought and sold in two markets: voluntary and compliance. The voluntary markets are based on the decarbonization goals of each company. The compliance markets are based on emissions compliance requirements in a cap-and-trade system – the number of emissions a company can emit and allow companies to trade for the emissions they save.

Types of Carbon Credits

Carbon credits are generated from nature-based or engineered-based projects.

Forest and Land Use: Projects for reforestation, deforestation, and natural resource conservation can generate carbon credits. Farmers and landowners can sell a carbon credit for every CO2 their land sequesters.

Renewables and Oil and Gas: Companies creating wind, solar and hydroelectric power can sell the carbon emissions they avoided as carbon credits. Companies that shut down oil and gas wells can sell the carbon emissions they avoided as carbon credits.

Carbon Capture and Storage: Companies that suck carbon directly out of the air and sequester the carbon for long-term storage can sell their captured carbon credits.

Carbon credit benefits from the three most significant economic sectors generating greenhouse gas emissions include:

Electricity and Heat Production Benefits

- Support integration of electric and hybrid vehicles.

- Fund the design and implementation of sustainable public transport.

- Finance the development of low-impact hydroelectric technologies.

- Finance direct-air capture tech and bioenergy with carbon capture and storage.

- Support the installation of solar panels in low-income communities.

- Support solar microgrids in rural areas.

Industry Benefits

- Promote supply chains prioritizing low-carbon methods and sustainable materials.

- Support programs for zero waste in manufacturing and industrial waste to energy.

- Fund projects that safely dispose of or reduce hazardous waste.

- Assist the aviation industry in moving to sustainable fuel alternatives.

- Assist fisheries facing changing climate conditions to adopt sustainable practices.

- Support projects that minimize flaring and venting in oil and gas production.

Agricultural, Forestry and Land Use Benefits

- Facilitate sustainable land use, integrating practices that protect and enhance land’s productivity and ecological health.

- Educate farmers about sustainable agricultural practices.

- Incentivize practices for soil health improvement through carbon sequestration, increasing crop yield.

- Support agricultural water management strategies optimizing water use.

- Enhances food security by funding the development of crop varieties resistant to drought and implementing sustainable grazing practices.

- Fund the expansion of vertical farming, increasing land and water use efficiencies.

Voluntary Carbon Market Registries and Credit Rating Agencies

The voluntary carbon market (VCMs) has grown substantially in recent years, as has greenwashing incidents. Historically, carbon credits have been difficult to validate and demonstrate that they are sequestering, reducing, mitigating or avoiding the amount of carbon they claim. A growing industry of independent carbon credit verifiers emerged in recent years, including carbon credit rating agencies that independently assess carbon credits and assign a credit score based on various factors, including the project’s environmental and social impact. These credit ratings are generally used along with a carbon registry’s protocols. The largest carbon credit rating agencies are BeZero, Calyx and Sylvera.

The Core Carbon Principals (CCP), published by the Integrity Council for the Voluntary Carbon Market, set a global benchmark for high-quality carbon credits. These principles outline 10 key criteria and ensure carbon credits awarded to the CCP label meet stringent standards.

Most carbon credit registries use similar principles. American Carbon Registry, Climate Action Reserve, Gold Standard, and Verra are the oldest and largest voluntary carbon credit registries. None of these four registries utilizes blockchain technologies. This drove the emergence of many blockchain-based carbon credit registries.

Once validated, carbon credits may be transformed into digital currency on a blockchain network. The blockchain can help ensure that environmental claims, such as carbon reductions and avoidance of greenhouse gas emissions, are verifiable and accurate.

High Quality Carbon Credits

- Higher quality credit often results in higher prices. Principals include:

- Transparency – Limited information is available for the vast number of methodologies to count avoided or reduced carbon emissions.

- Double Counting – No central carbon credit repository exists, and many registries exist. Someone may sell the same credit to more than one registry.

- Additionality – Carbon credit emissions avoided or reduced is additional such that it would not occur at all if the project did not exist.

- Permeance – The carbon credit will have a lasting impact on reducing carbon emissions.

- Governance – Improves transparency, accountability, and participation while increasing public engagement.

- Overestimation – The estimated carbon emission impact quantified is accurate.

- Co-Benefits – In addition to carbon reduction, avoidance or sequestration, projects providing additional environmental, social or economic benefits offer more value.

- Quantification, Monitoring, Reporting and Verification – Practices should involve rigorous data collection and third-party verification for accuracy and verification.

Return on Investment (ROI)

A company’s decarbonization strategy, financial performance, environmental and social impact are intertwined with its sustainability and risk mitigation strategies. The energy transition is catalyzed by digitalization, emerging technologies, innovative energy finance strategies, increased R&D investment, public/private partnerships, new laws and regulations.

Upfront capital expenditures and long-term returns vary according to several factors, including economic industry sector, geographic location, and carbon emission baseline. According to McKinsey, top-line gains from fostering energy efficiency aimed at curtailing energy usage, lowering operating costs, and adopting cutting-edge technologies have resulted in up to a 60 percent enhancement in operating profits.

The stakeholder communication feedback loop employed in the initial decarbonization plan design can provide data indicating improved stakeholder and investor relations and its positive impact on workforce retention, employee engagement, and community relations. Sustainability positively impacts consumer loyalty and brand reputation. Emphasizing decarbonization is pivotal to employee engagement, according to McKinsey’s research.

For companies manufacturing consumer products, research shows that 66 percent of global consumers are willing to pay more for sustainable goods (73 percent of millennial consumers). Prioritizing sustainability results in increased sales revenue.

The modern workforce is often comprised of teams within the age range of 20s to 70s. Deloitte’s retail worker research shows employee retention is tied to sustainability. Forty percent of survey respondents reported changing jobs or planning to change jobs due to climate concerns. According to Deloitte’s research, companies with an integrated sustainability strategy experienced a 13 percent increase in employee productivity and up to a 50 percent turnover reduction.

The financial landscape of decarbonization is shaped by the accessibility of government subsidies, including the 2022 Inflation Reduction Act, grants and tax incentives, generally offsetting initial investment costs, and enhancing financial profitability. According to S&P Global, decarbonizing the economy could take the global green, social, sustainability and sustainability-linked bond market closer to the $1 trillion mark.

Blended finance strategies and the strategic use of government capital, such as those from government, philanthropic and commercial capital, are growing in the U.S. This financial structure mitigates risk and facilitates financing for private sector-led projects that have the potential to generate environmental and social benefits.

The energy transition is transforming businesses across economic industry sectors, enhancing a company’s climate resilience – the ability to adapt and operate due to climate-related challenges such as extreme weather events. Being prepared by regularly monitoring company operations, accessing long-term risk mitigation strategies, and adapting to unexpected impacts on operations, supply chains, and employees may uncover new opportunities and strengthen resilience.

Headline image source: S&P Global 2023

Dedicated to advancing a global sustainable economy, with over 25 years as a chief investment officer, business advisor, and board director, Dail St. Claire began her career managing assets for New York City’s $240Bn pension fund. Her service includes being a financial advisor for the Episcopal Church Endowment and Foundation.

St. Claire has advised global corporations and middle market companies with P&L responsibilities as a board director, energy and utility investment banker and investor. With a track record of growing and scaling businesses in highly regulated industries, she co-founded Williams Capital, the largest women- and minority-owned broker-dealer investment bank in the United States today.

St. Claire is the Chief Investment Officer and Sr. Energy Advisor at Aurivos, a family office with deep experience investing in climate tech and energy strategies. Experienced in alternative investments and climate finance, her focus includes designing innovative financial structures for institutional and nonprofit investment in energy, agricultural technology, low carbon, and zero carbon solutions and social impact.

BOARD SERVICE • Independent Board Director, Audit Committee Member, Verde Clean Fuels, NASDAQ: “VGAS”, 2023 – present • Independent Board Director, CRS Temporary Housing, 2021– present • New York State Common Retirement Fund Investment, Board Member, Investment Advisory Committee – Sustainability & Climate Fund, Corporate Governance, $260Bn AUM, 2021 – 2023.

An RRCA-certified running and fitness coach, St. Claire assists challenged athletes through the Achilles Foundation. She holds a BA in Cultural Anthropology from the University of California, San Diego, and an MA in Public Policy/Business from the University of Chicago Harris School. Contact dailst.claire@aurivos.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.